Hi, there! I'm Richie.

Are you having trouble signing up? Let me show it to you!

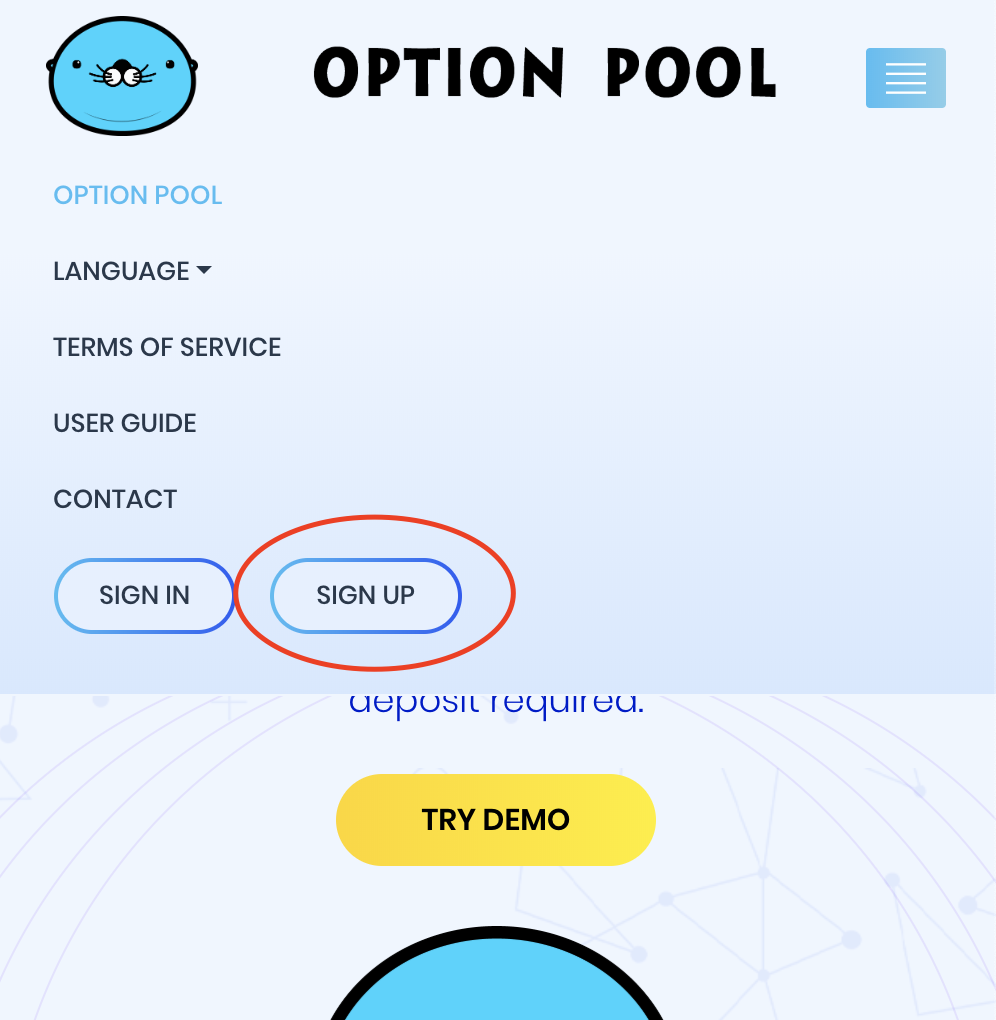

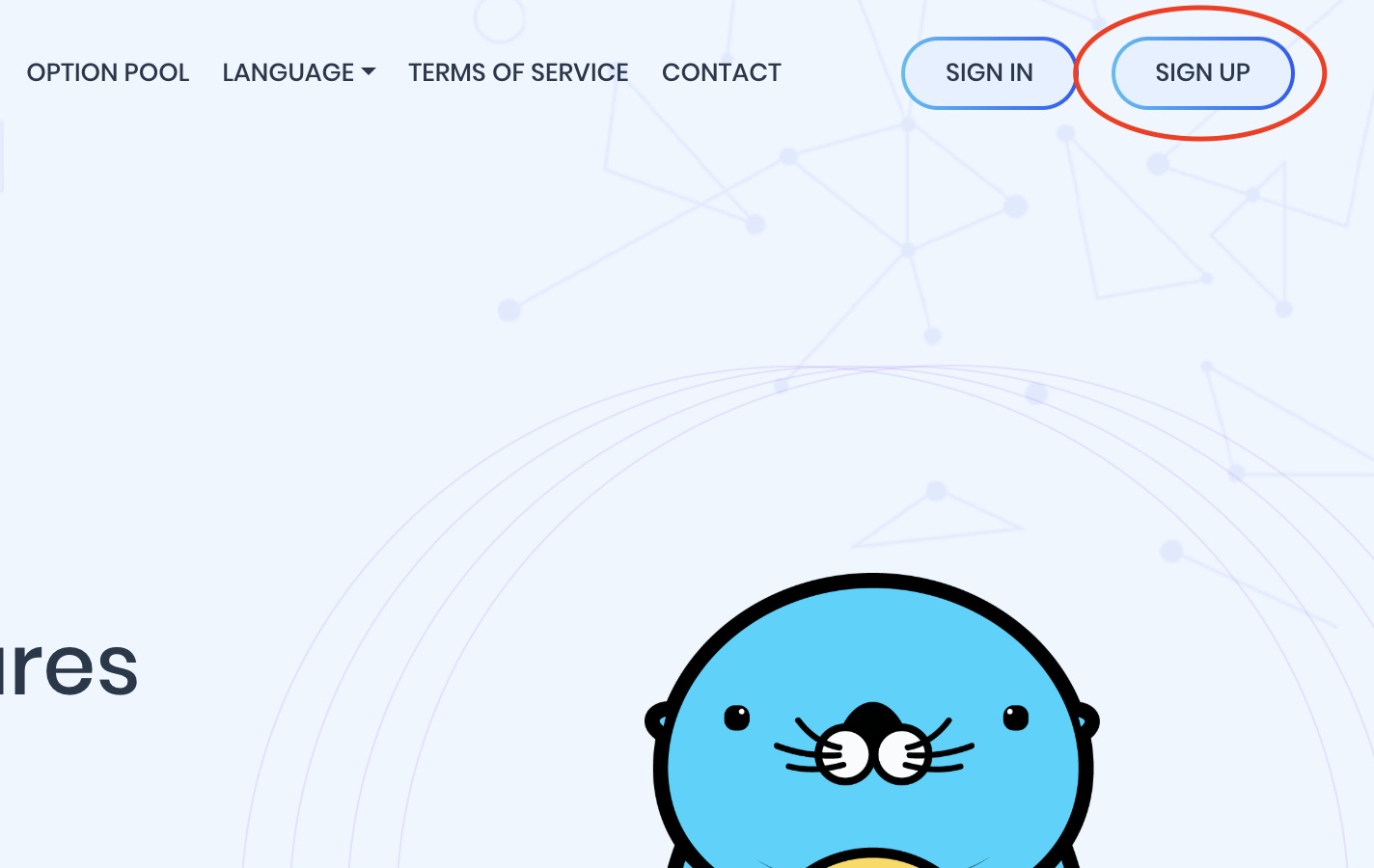

In the top right corner of the main page, there's 'Sign up' button.

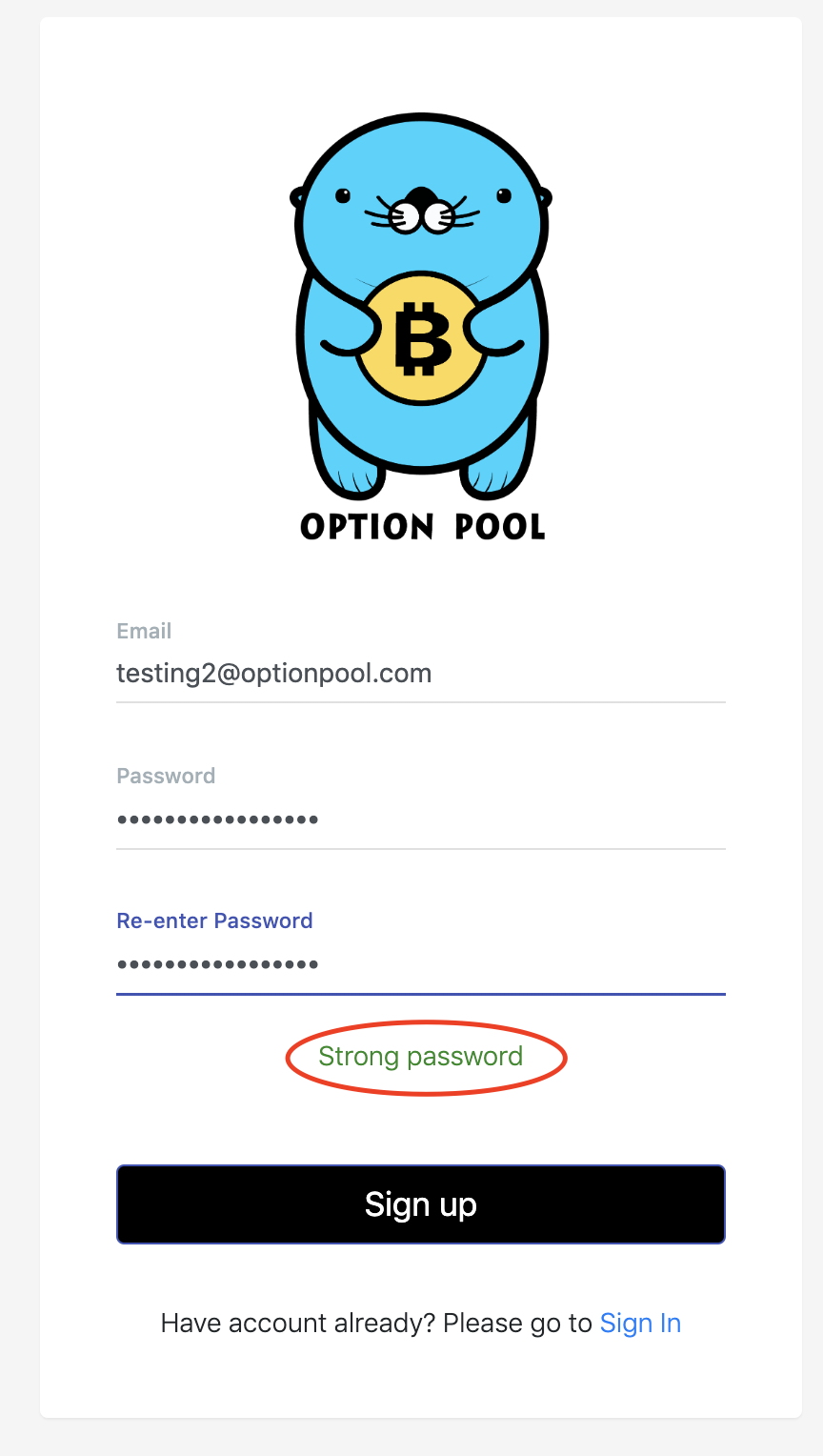

When you press the 'Sign up' button, you will see the following page.

One thing to remember is that there's no specific requirement about the password other than it should be complex enough to be safe from brute force attacks.

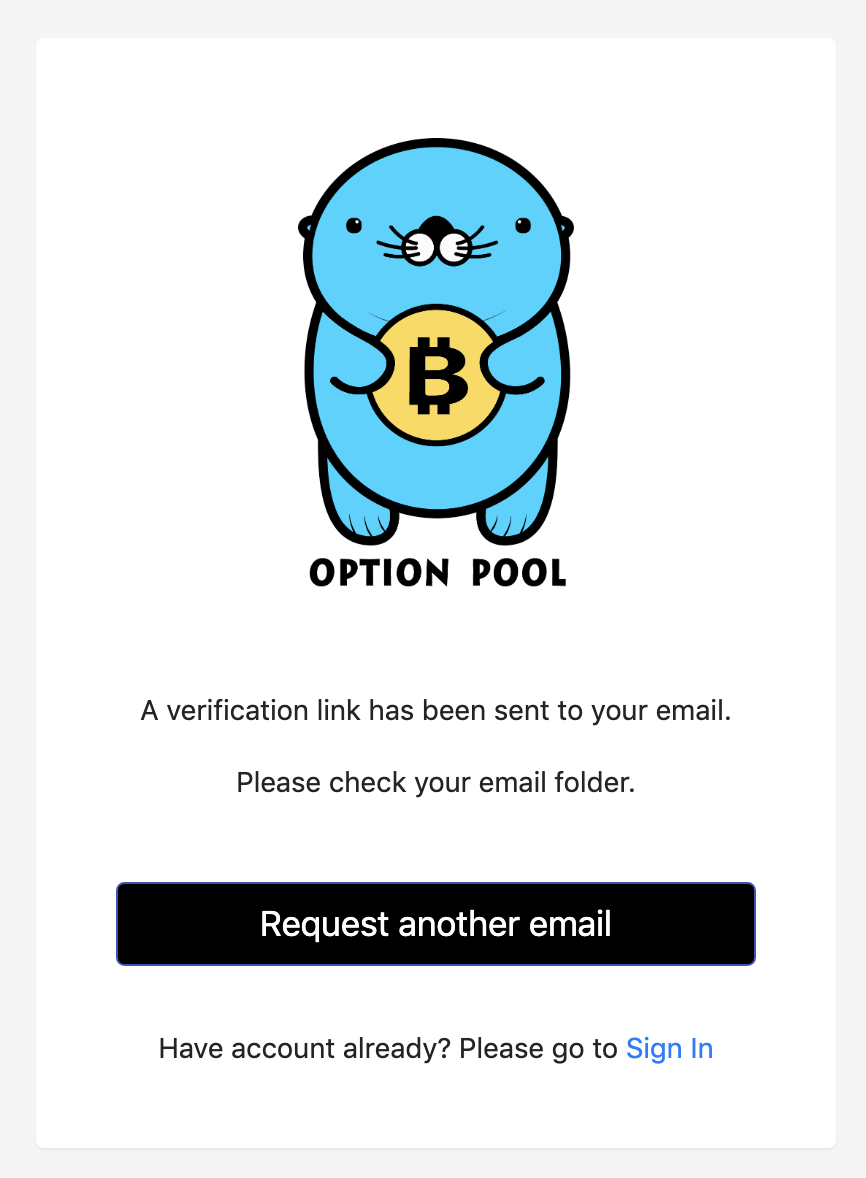

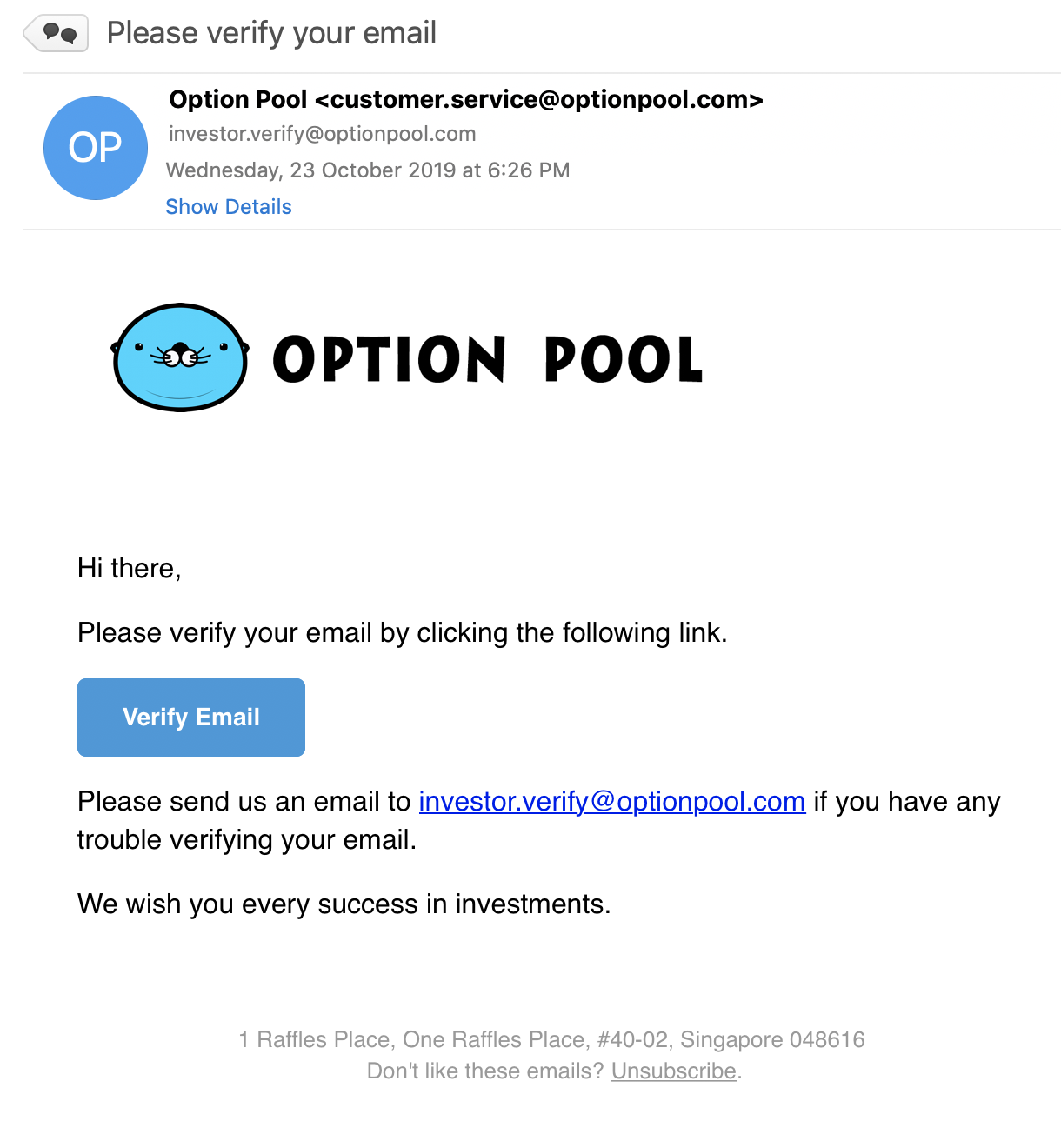

Press the 'Sign up' button at the bottom, and you will receive a verification request email.

Please click the link within 24 hours. After that the link will be expired.

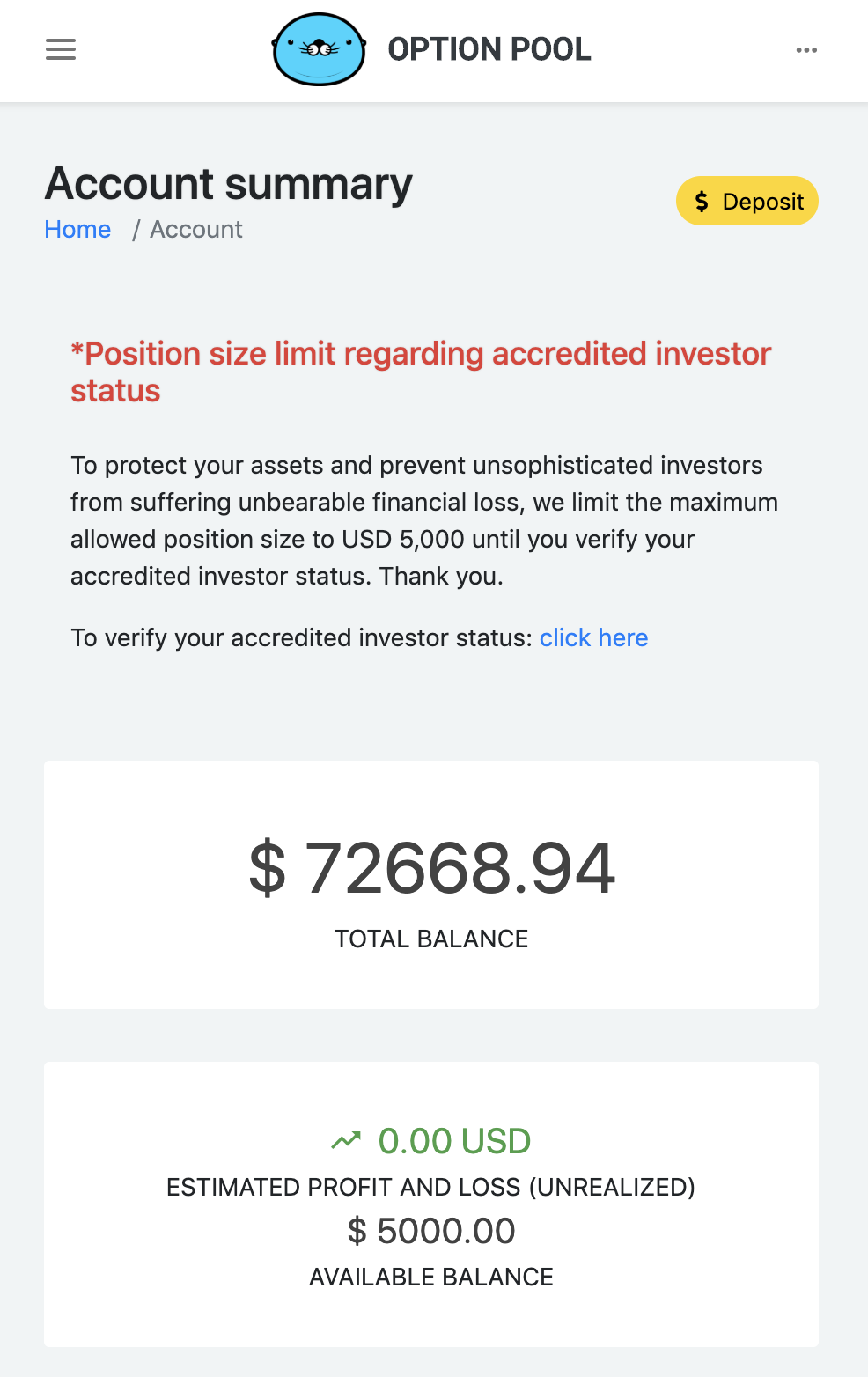

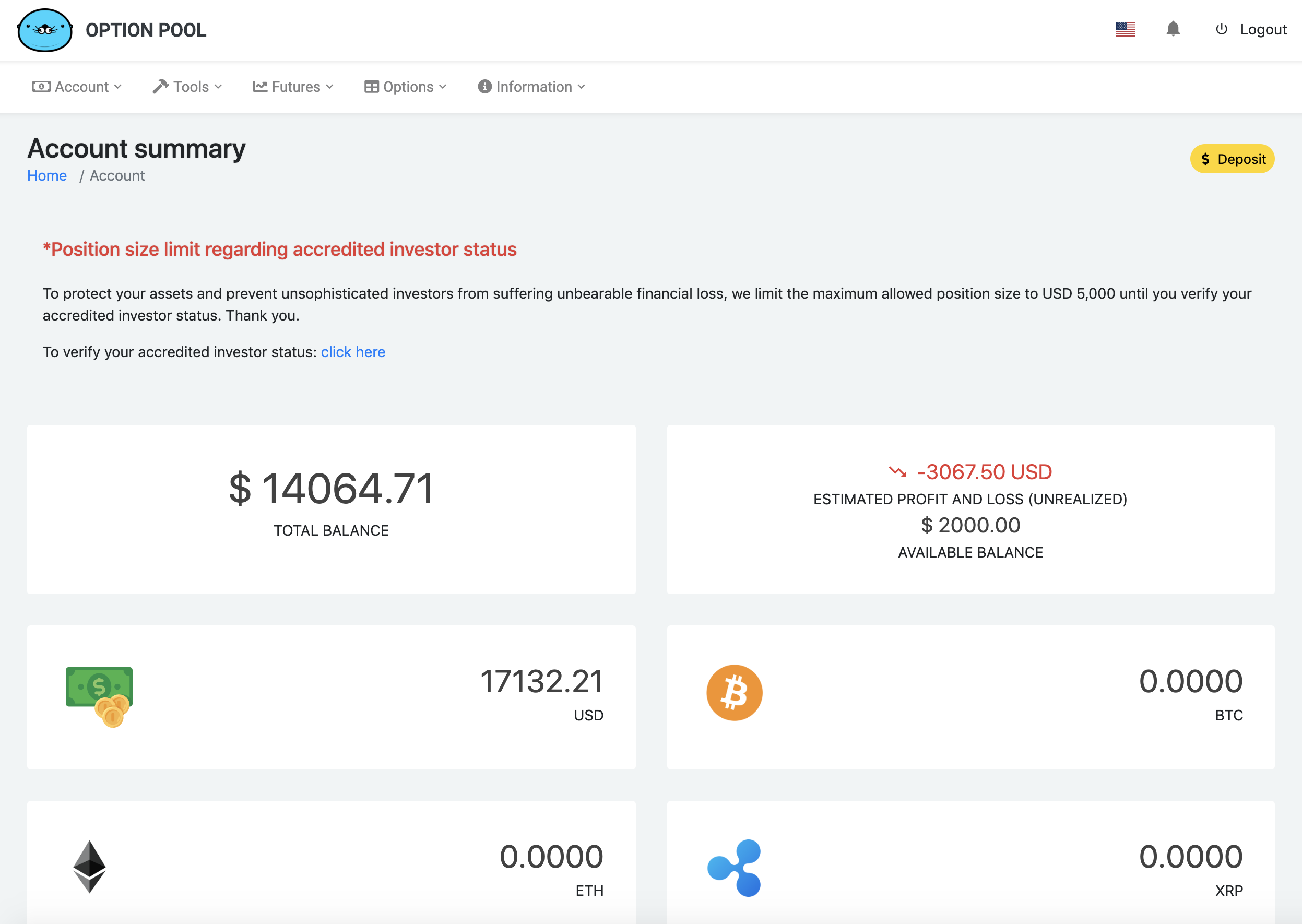

After email verification, you will be able to see your account summary page.

Congratulations! You have successfully created an Option Pool account!

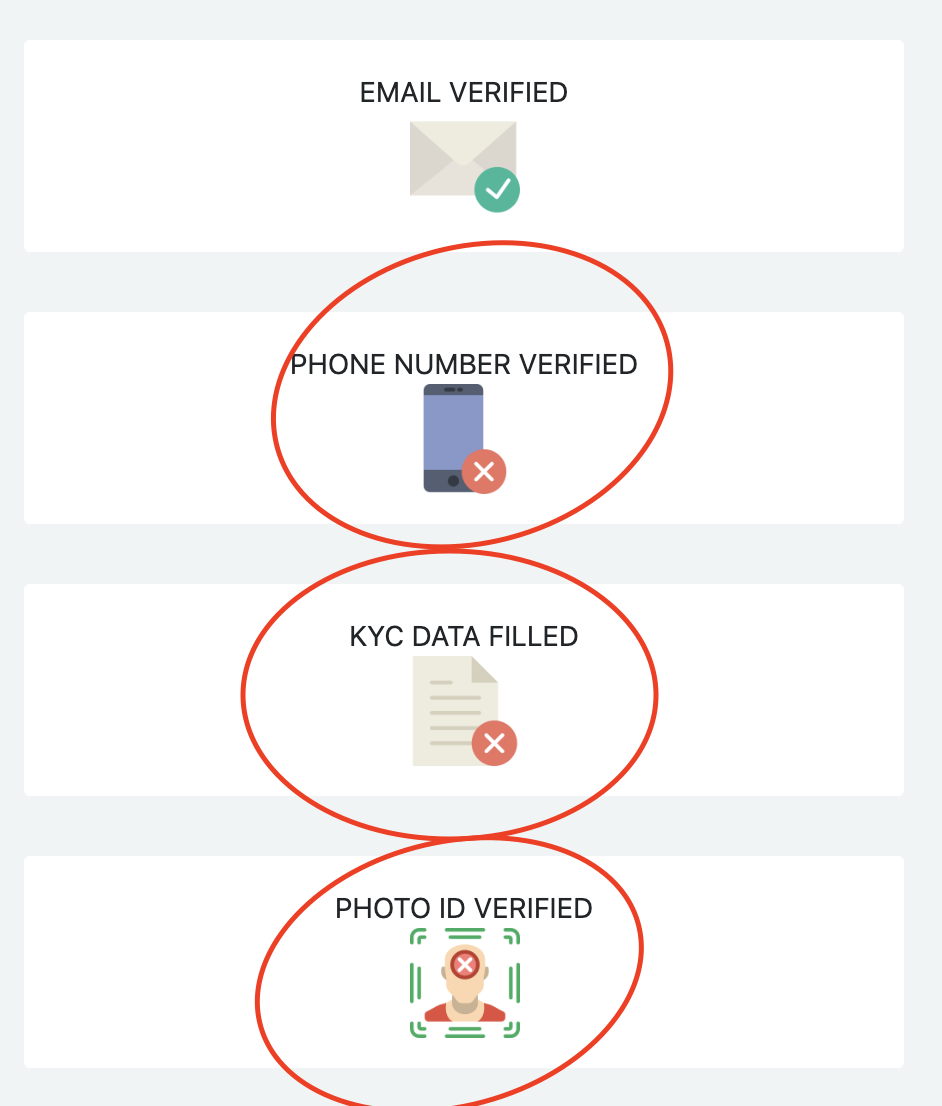

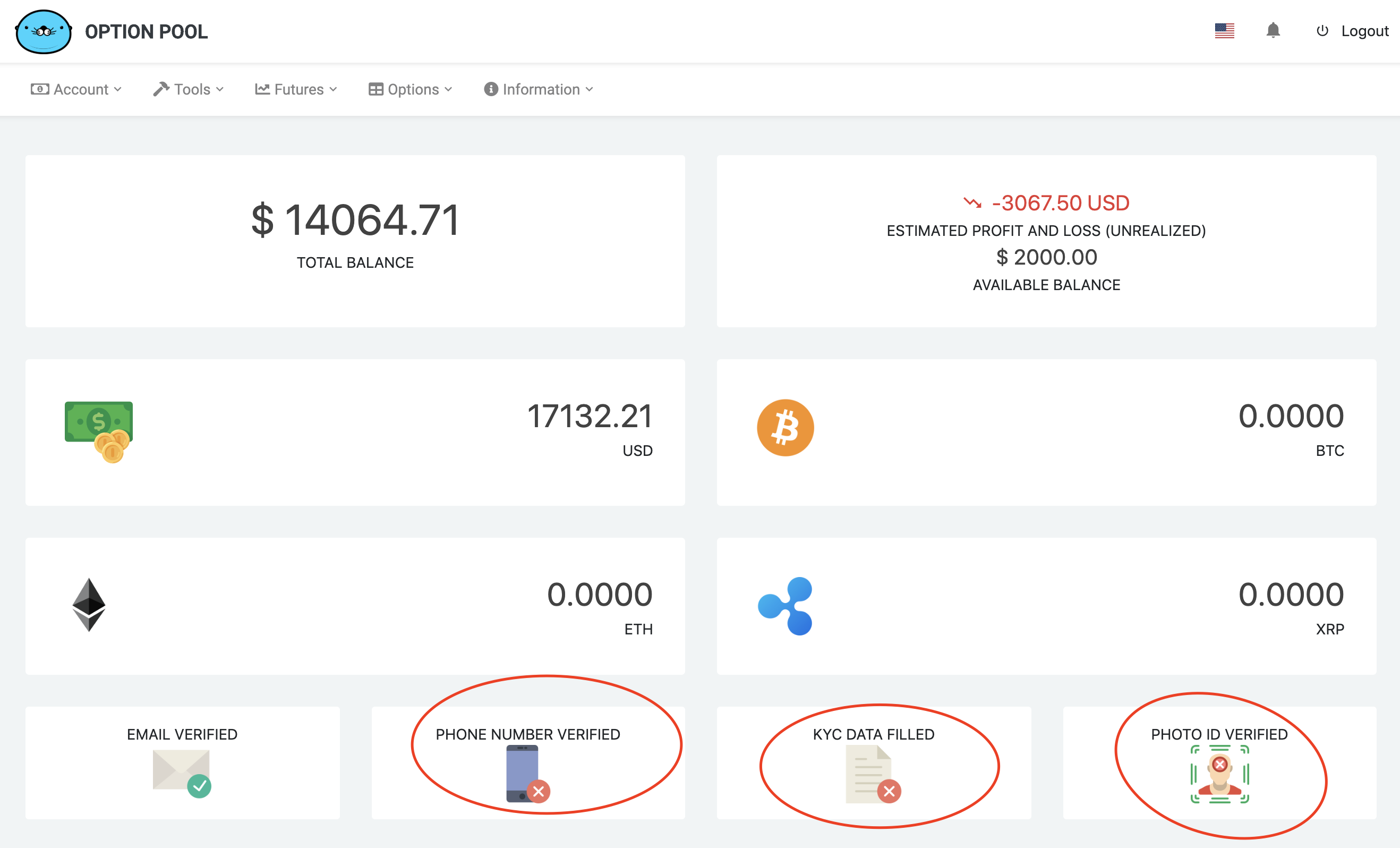

After logging in, you will be able to access your account summary page.

At the bottom of the page, there are four icons that show the status of the verification.

After the E-mail verification, you must pass 3 more verifications to make any transactions.

You might wonder why Option Pool has such stringent KYC requirements.

Because we are compliant with all laws of the relevant jurisdictions to prevent

Money laundering, Terrorism funding, and Tax evasion.

No worries! Your information will never, ever be exposed to anyone unless required by law.

Okay! Shall we get started?

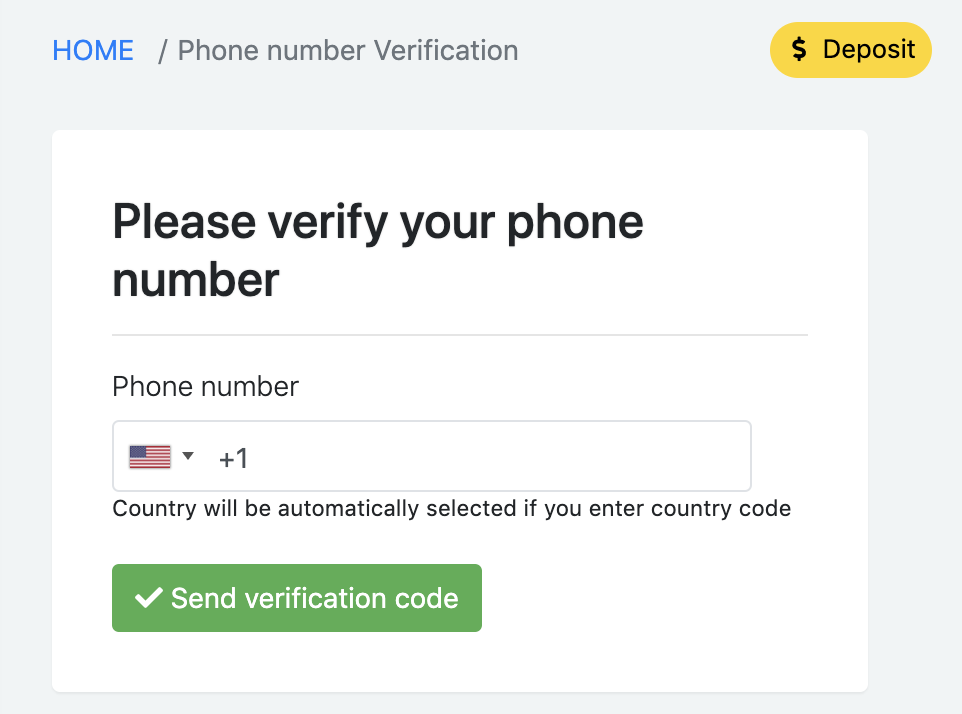

1. Phone number verification

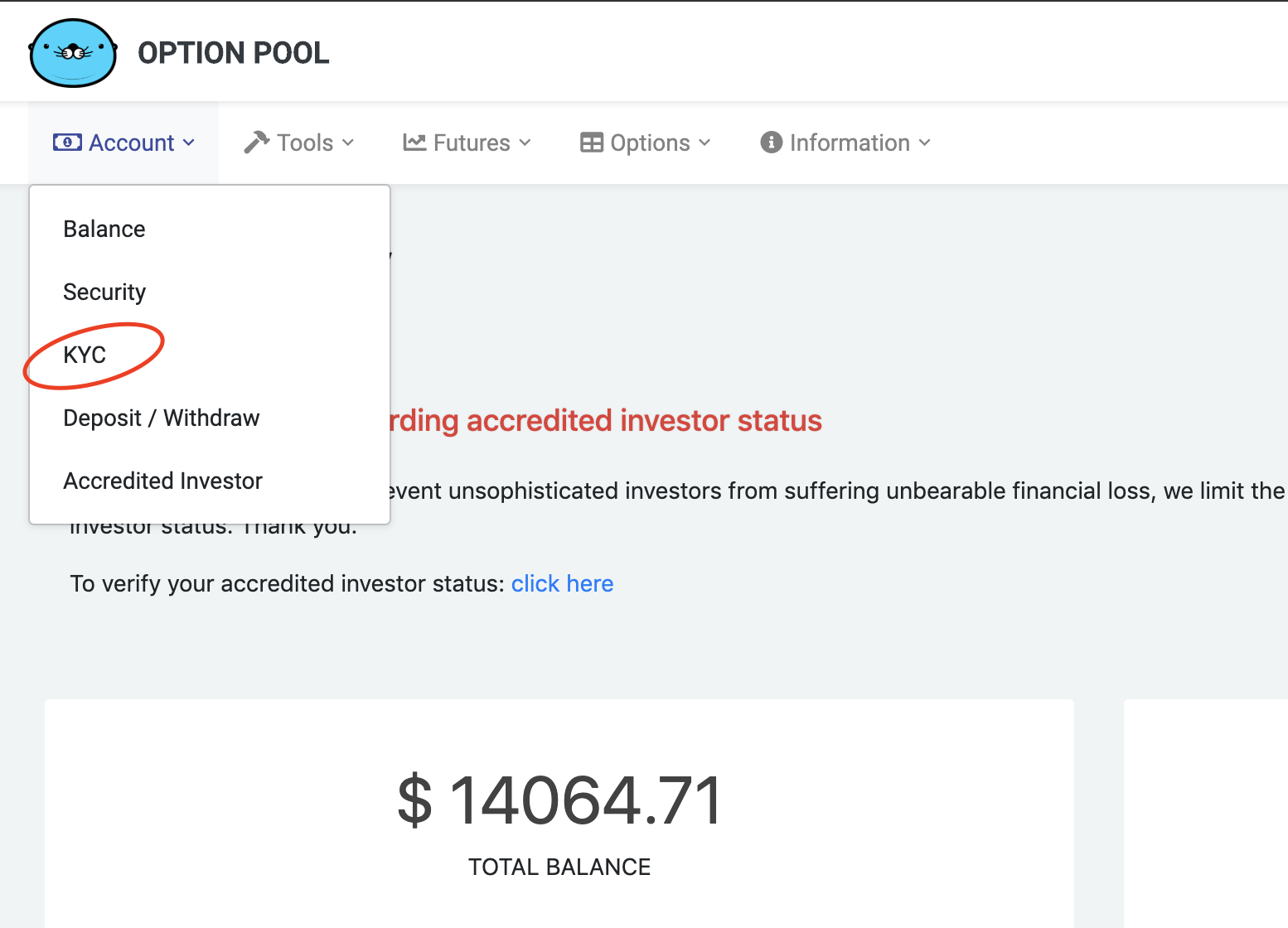

Go to Account > KYC. You will be asked to enter your phone number.

You can choose your country code from the tab. But if you know your country code already, it is easier to just enter it with your phone number.

(e.g. +1-917-xxx-xxxx)

(we will never spam you with this number, no worries)

Press Send verification code button to receive your code.

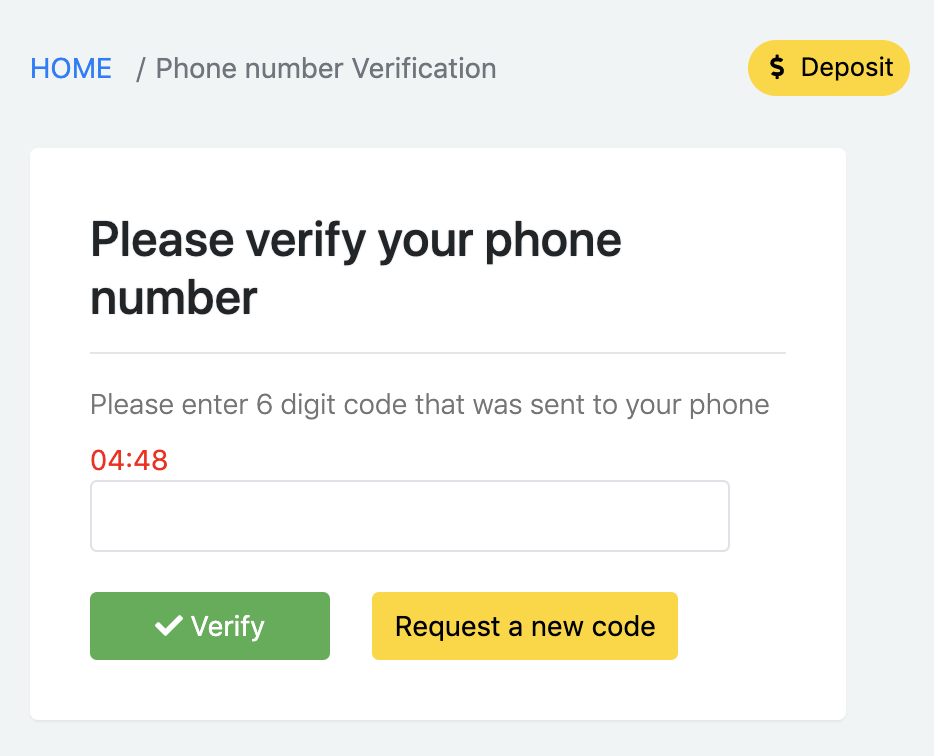

Please enter 6 digit code from the SMS message to complete your phone verification.

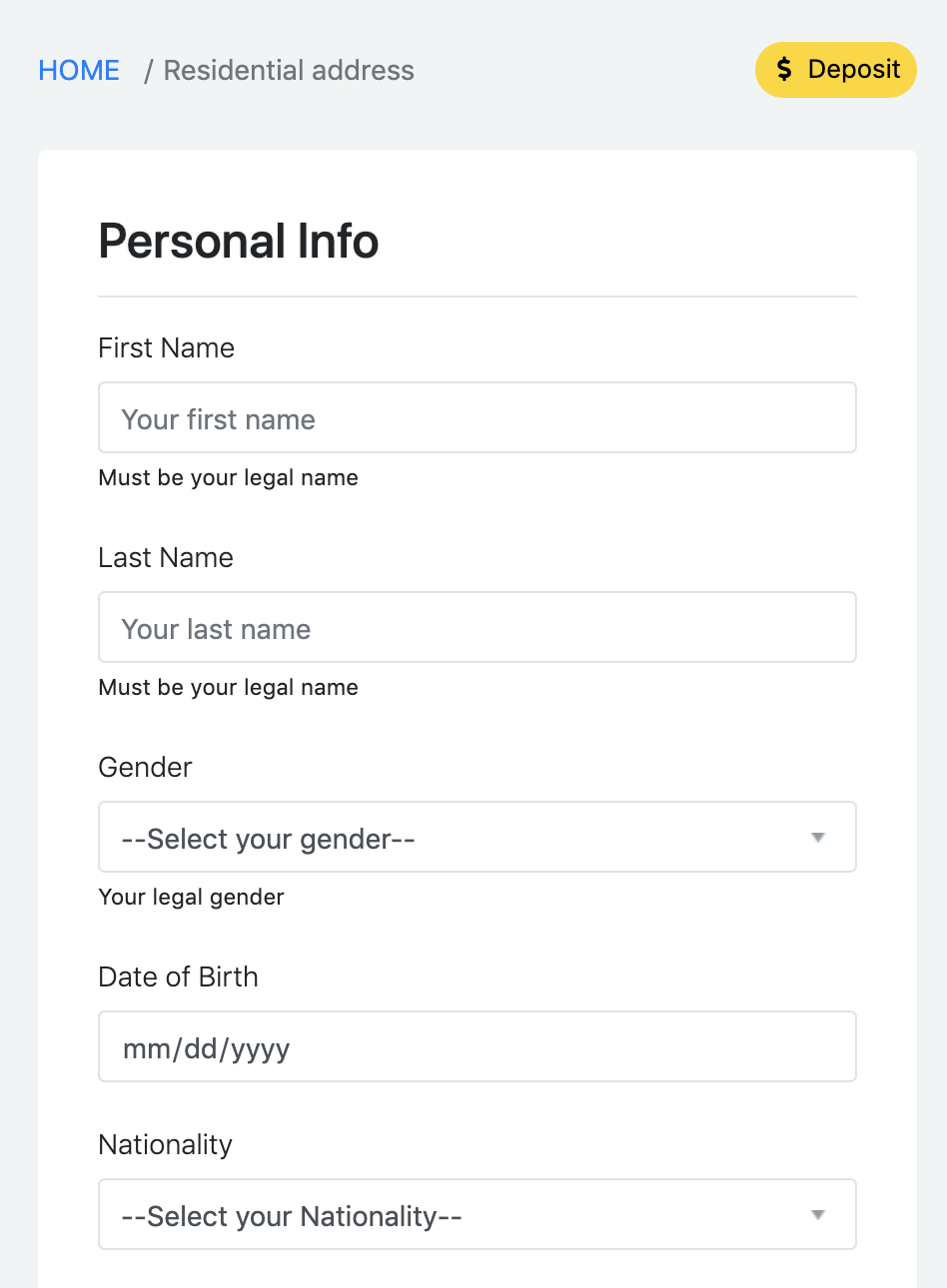

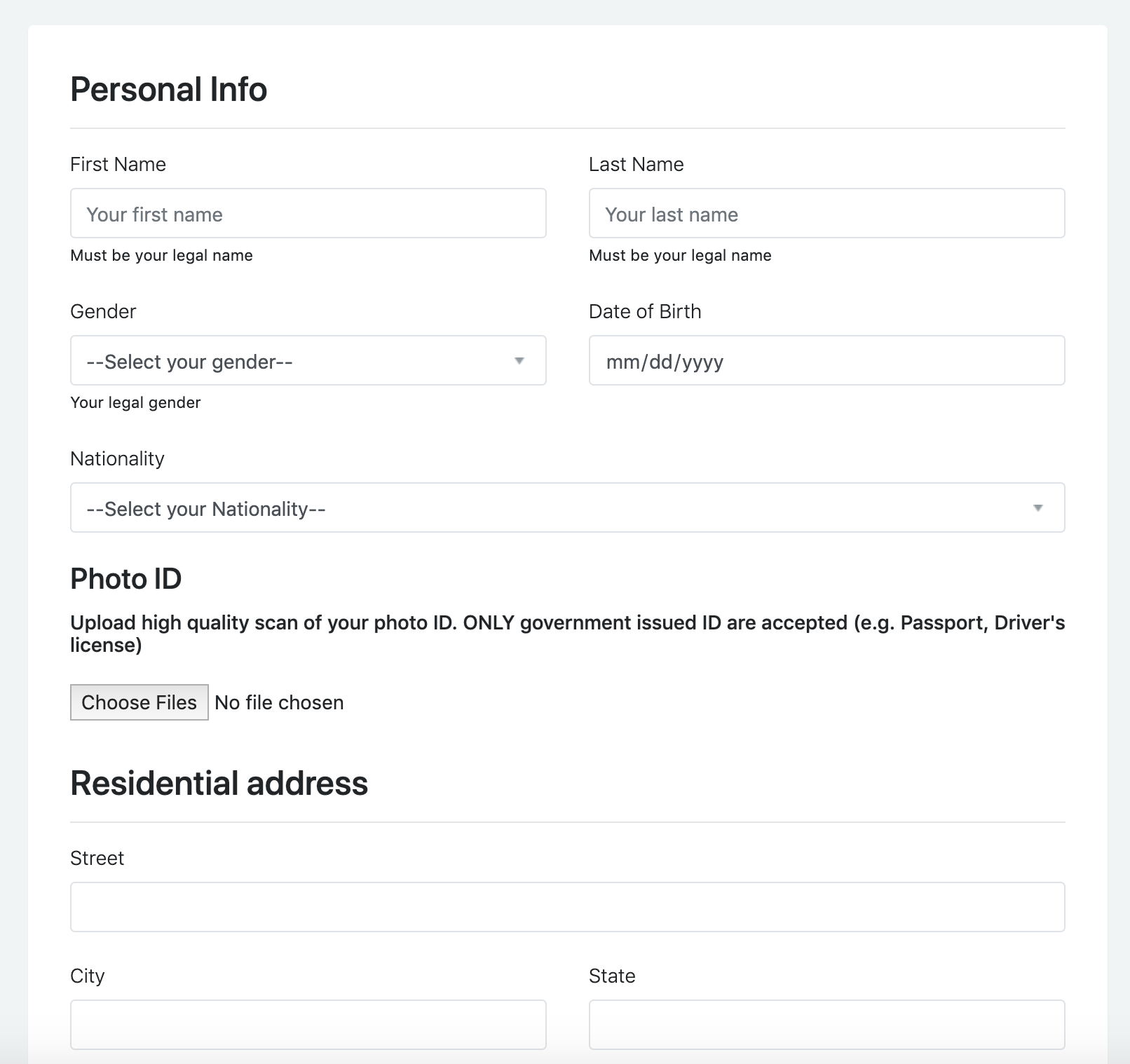

2. Personal information

After completing the phone verification, you will be able to access to your personal information page.

On this page, please enter your name, date of birth, residential information, and submit a scanned valid photo ID.

Only government-issued IDs are allowed, such as Driver's license and Passport.

The scanned photo ID must be visually clear enough to be processed electronically.

If you have a latest mobile phone, it will be enough to take a clear image of your photo ID.

(* You will not be able to go to the next page unless our server accepts your photo ID.)

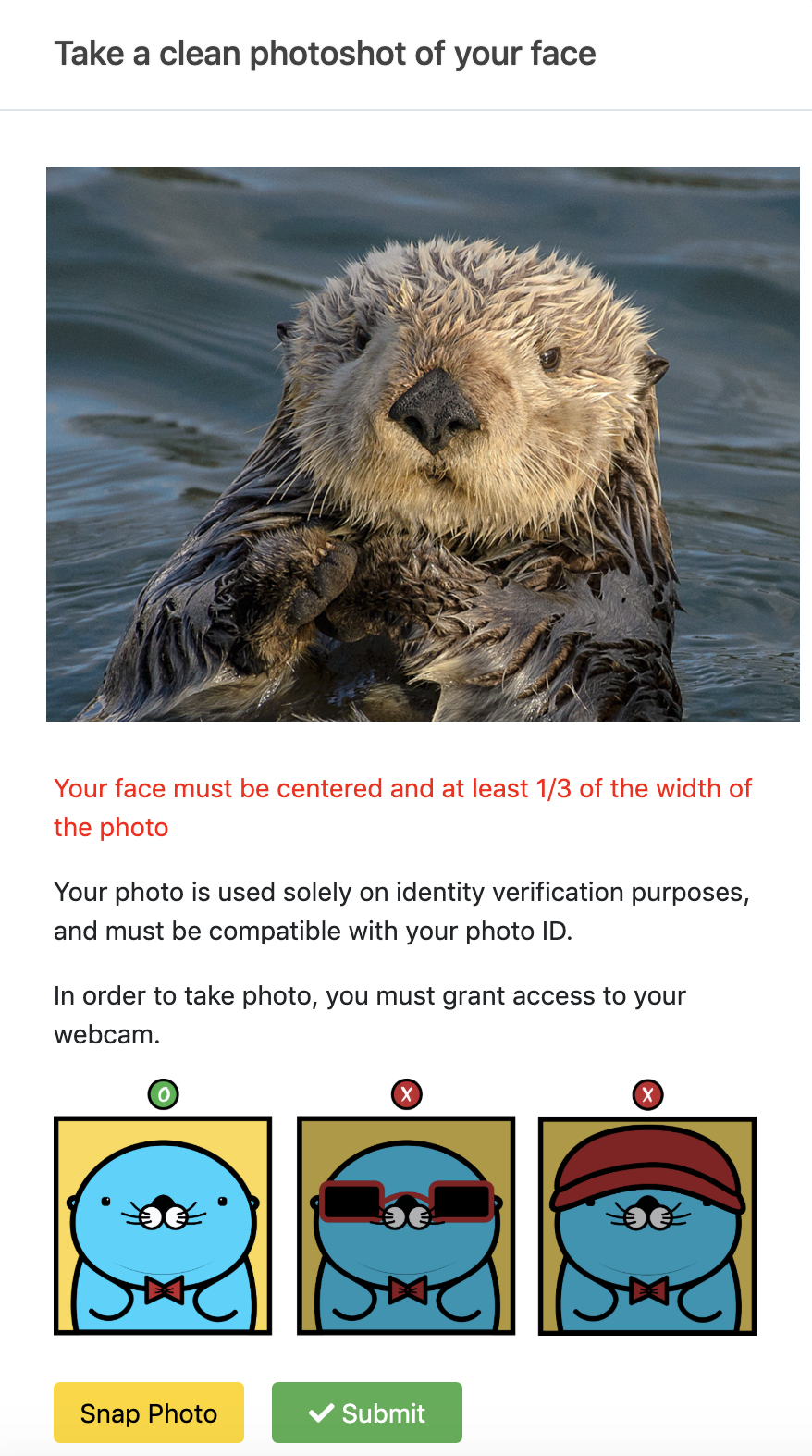

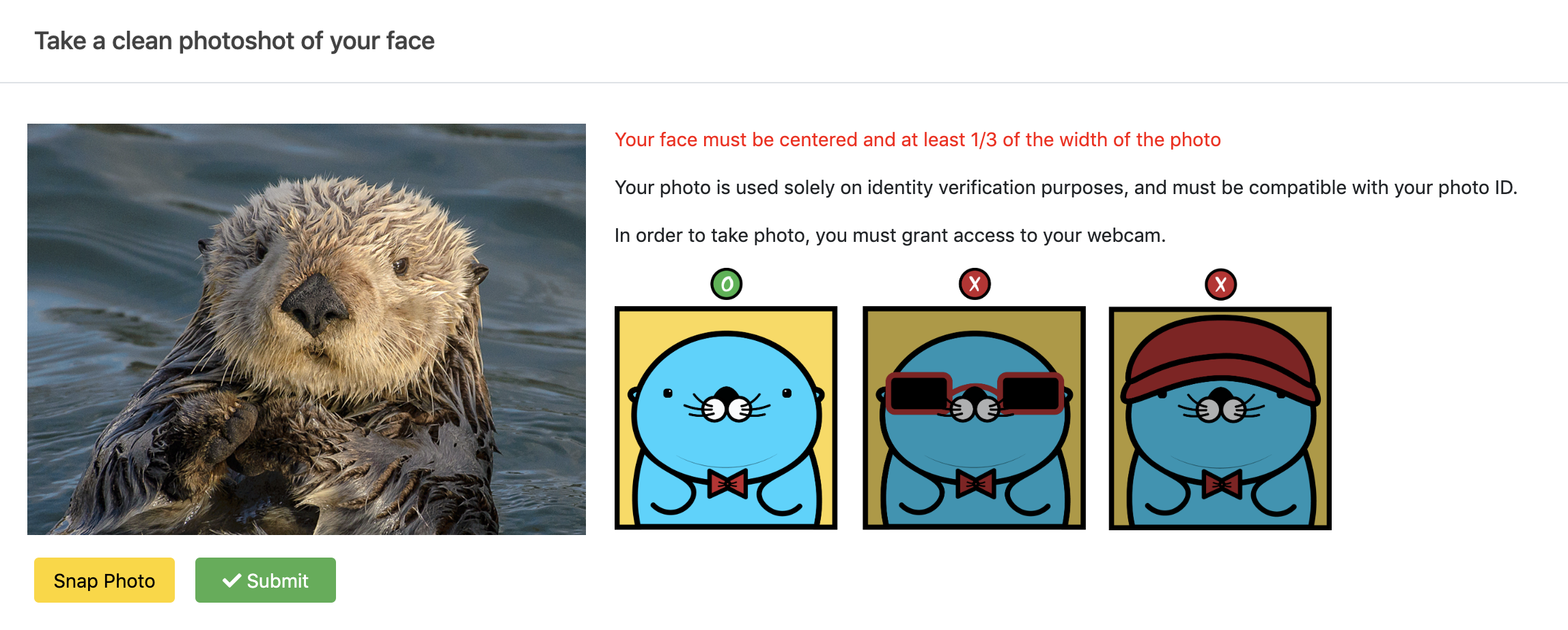

3. Selfie verification

Well done! You have come to the final stage of KYC verification.

We need to verify your selfie to see if your face matches the face in your photo ID.

On the selfie verification screen, make sure your selfie clearly shows your whole face.

Please take a selfie as instructed using your computer, or your mobile phone.

Once you are satisfied with your selfie, tap to submit the image.

(Please send us an email to investor.verify@optionpool.com if you have any trouble with passing this verification)

Well done! Now you are all set! Shall we start investing?

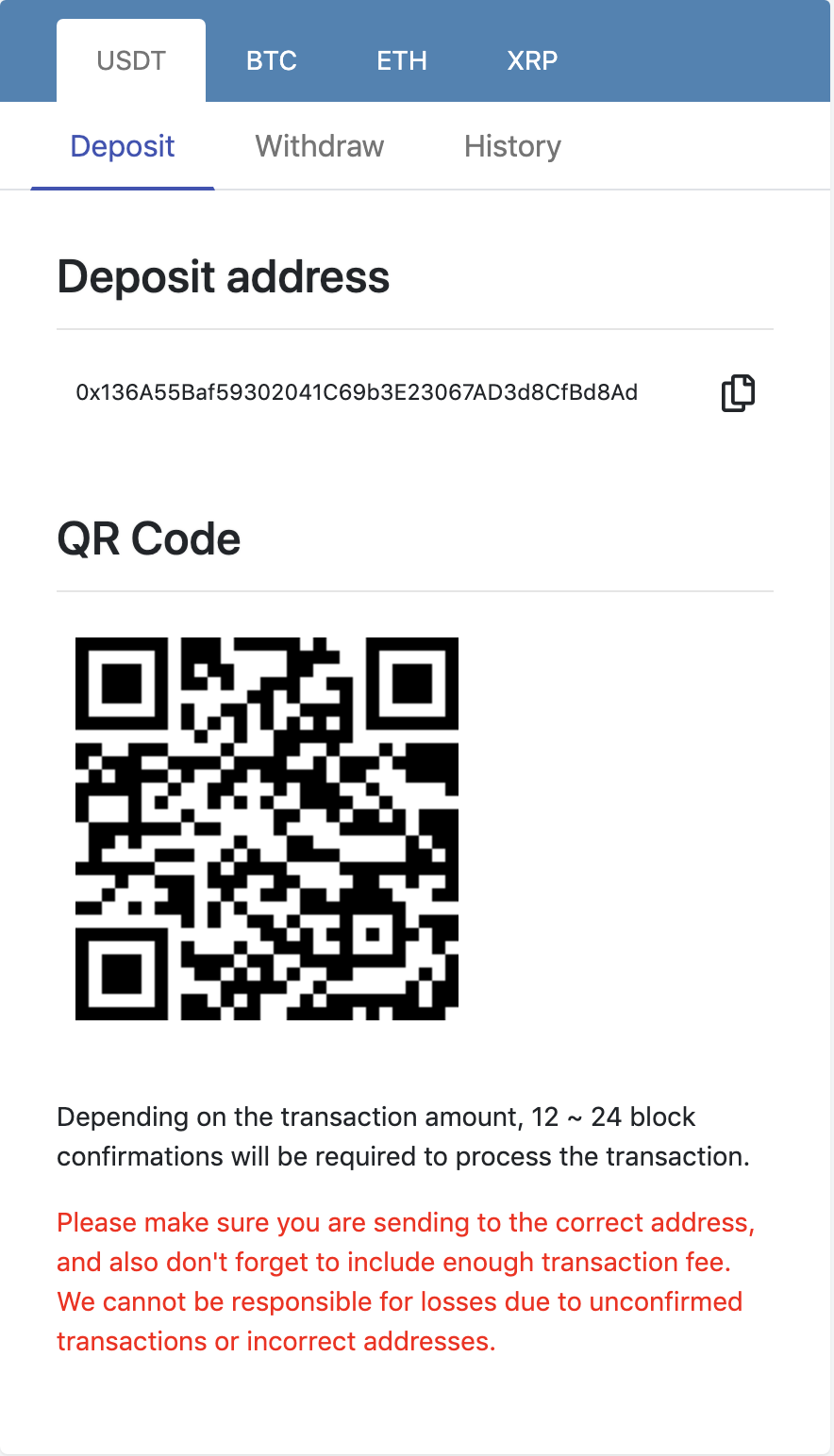

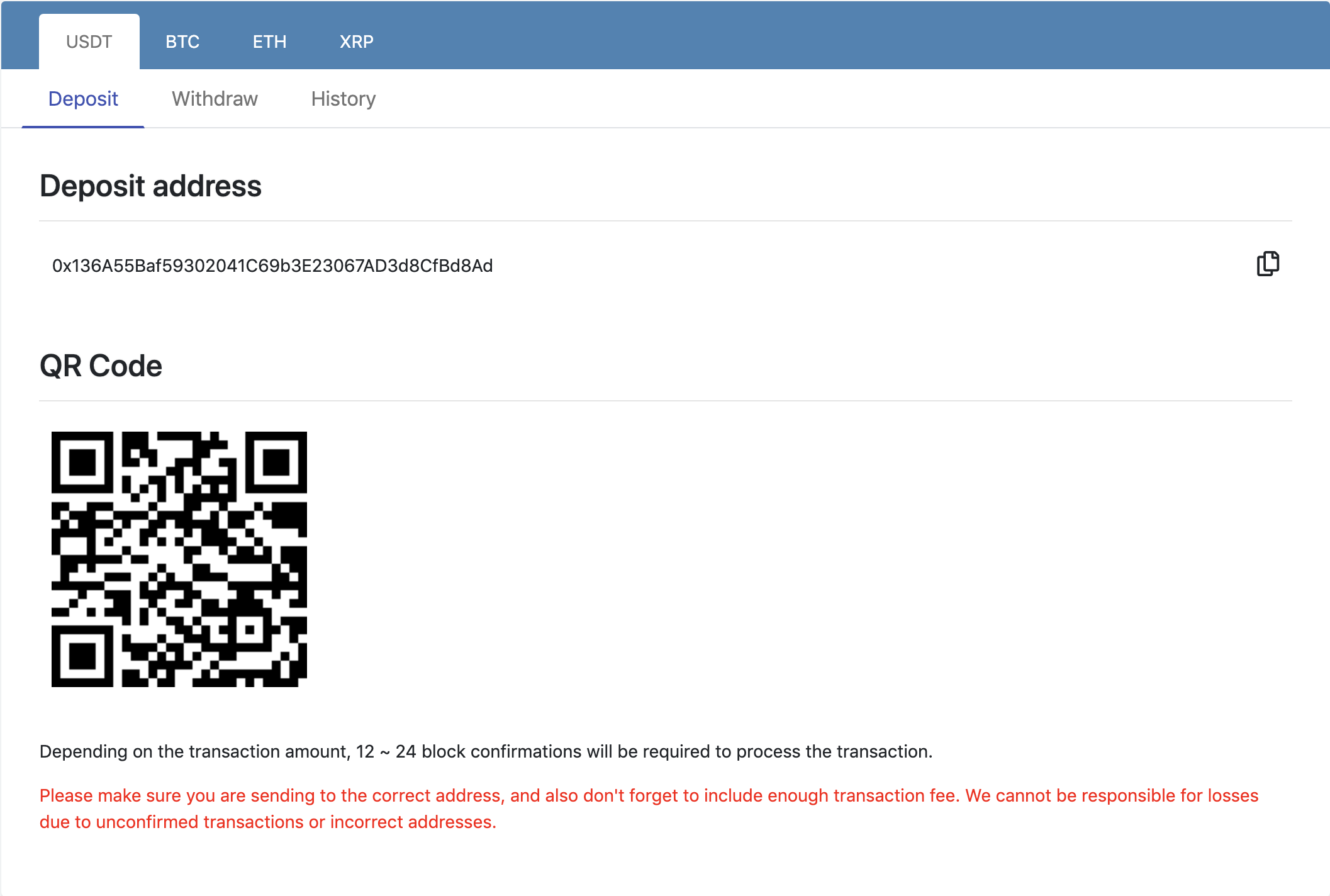

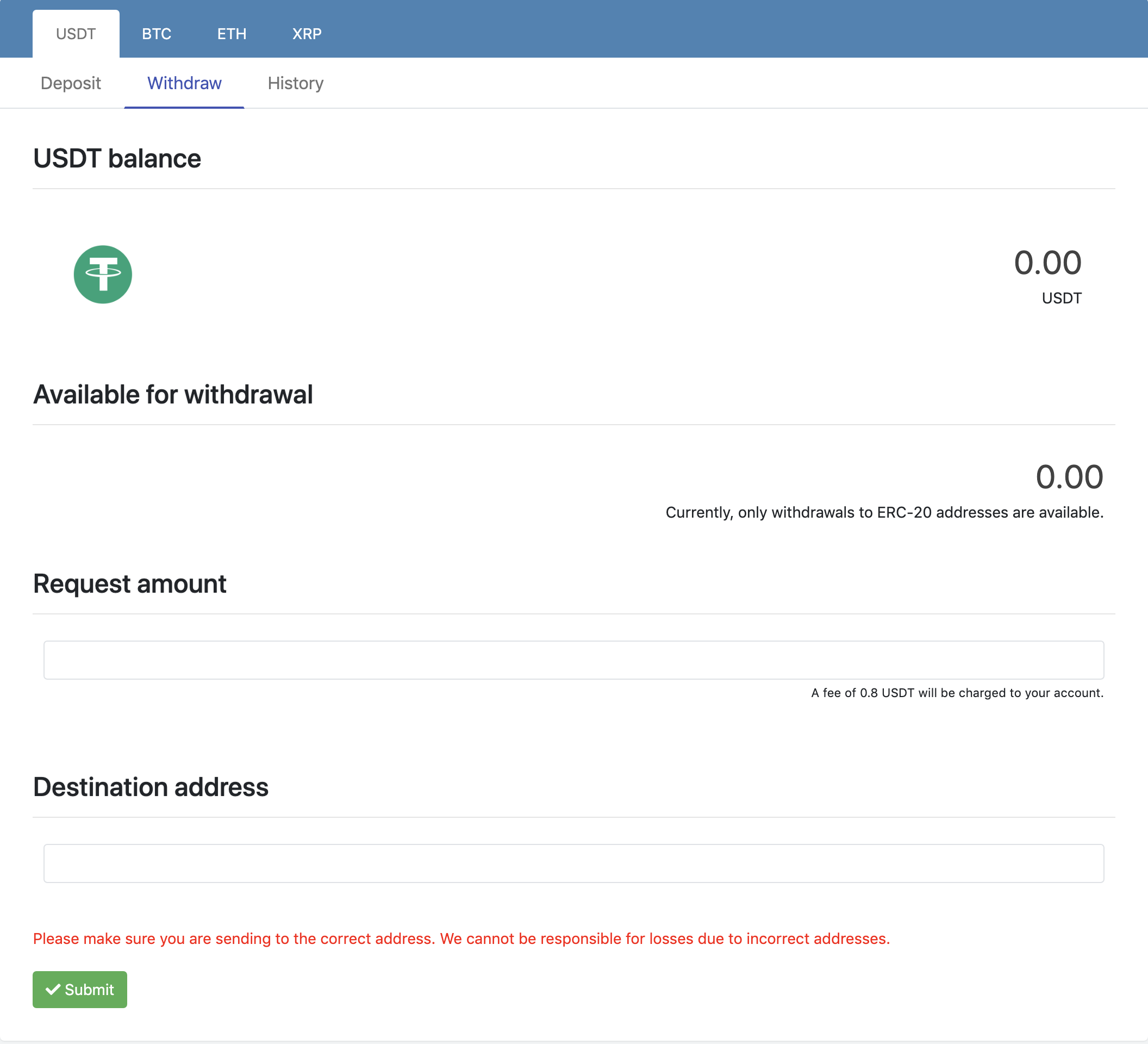

Now, let's learn how to deposit and withdraw.

Settlement of the contracts are in USDT

But, you can also pay your deposit for your orders in BTC, ETH, or XRP.

(your crypto deposit will be valued 97.5~99% of the market price when used as a margin deposit)

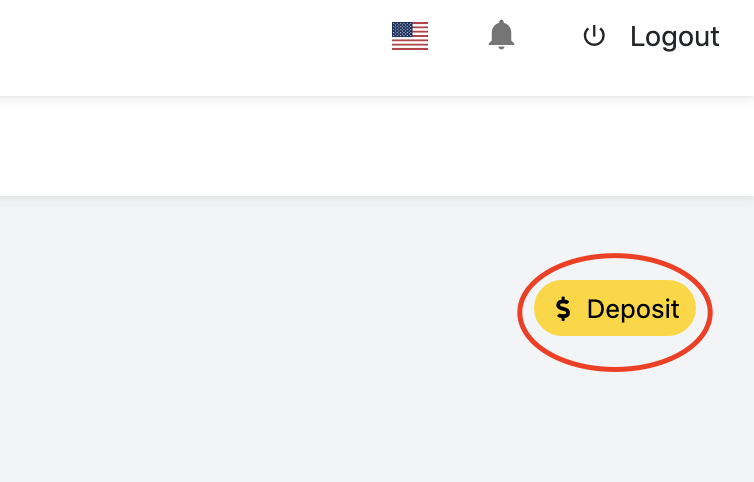

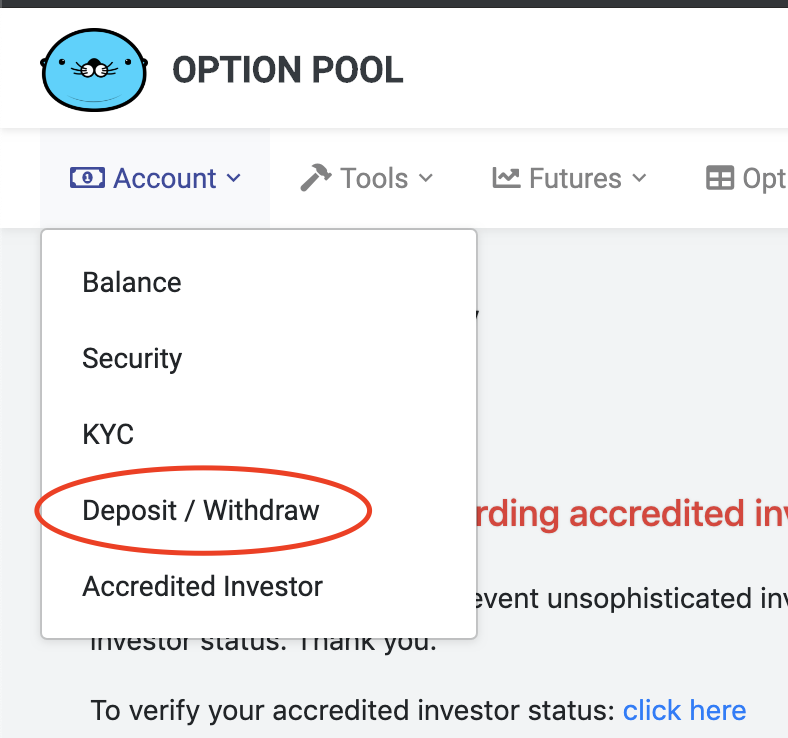

You can access Deposit/Withdraw page with these buttons:

Deposit button in the upper-right corner of the page.

or

Go to Account > Deposit/Withdraw

Bitcoin requires 1 to 6 block confirmations depending on the transfer amount.

Please allow 10~60 minutes to confirm the transaction.

(XRP deposit is immediately recognized, and Ethereum deposit takes at most 3 minutes.)

Always check if you are sending money to the right address.

(* Option Pool cannot be responsible for any loss due to incorrect addresses or unconfirmed transactions.)

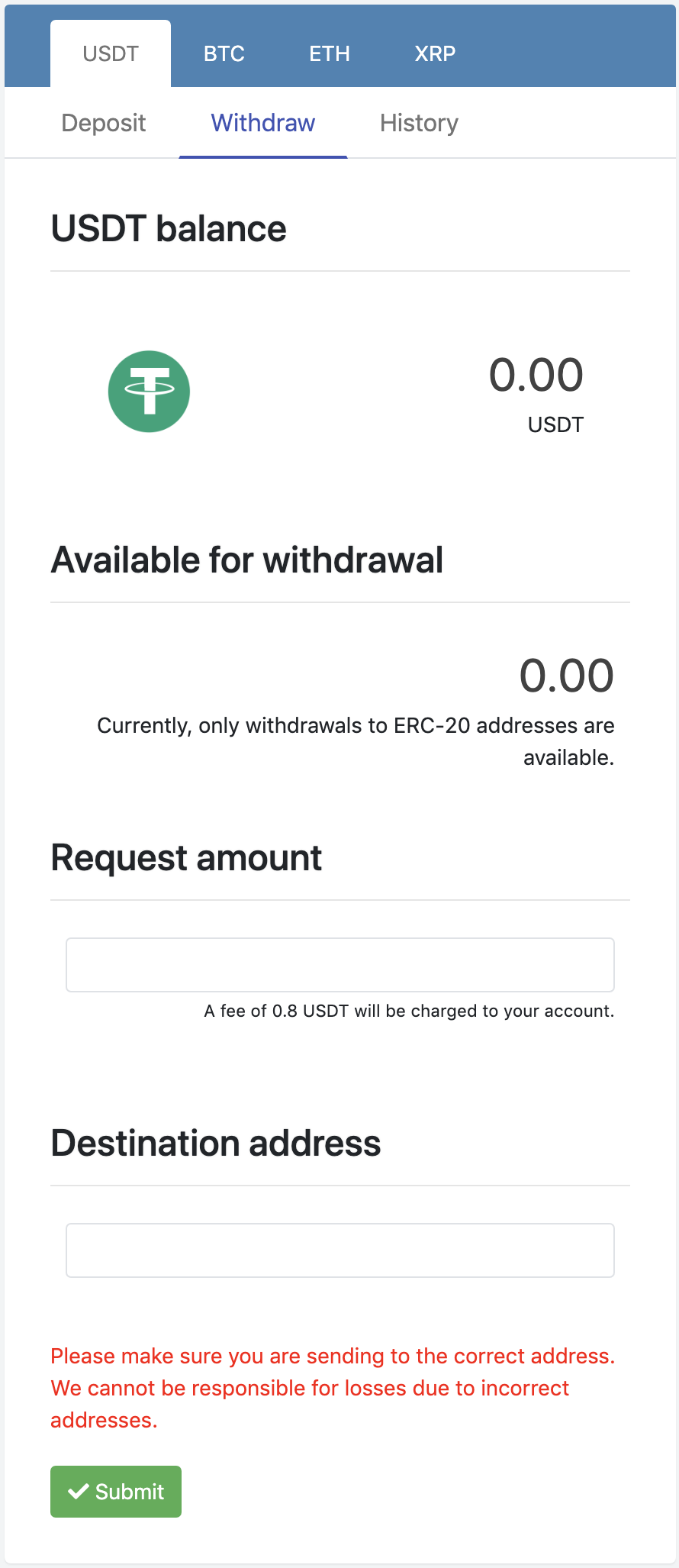

For crypto withdrawal, please submit the desired amount and address.

One thing to remember is that all crypto reserve of Option Pool are in the cold wallet in order to keep them secure.

Hence, when there is a heavy load of withdrawal requests, please expect some delays to respond to your request. (up to 48 hours)

Let's learn how to submit an order!

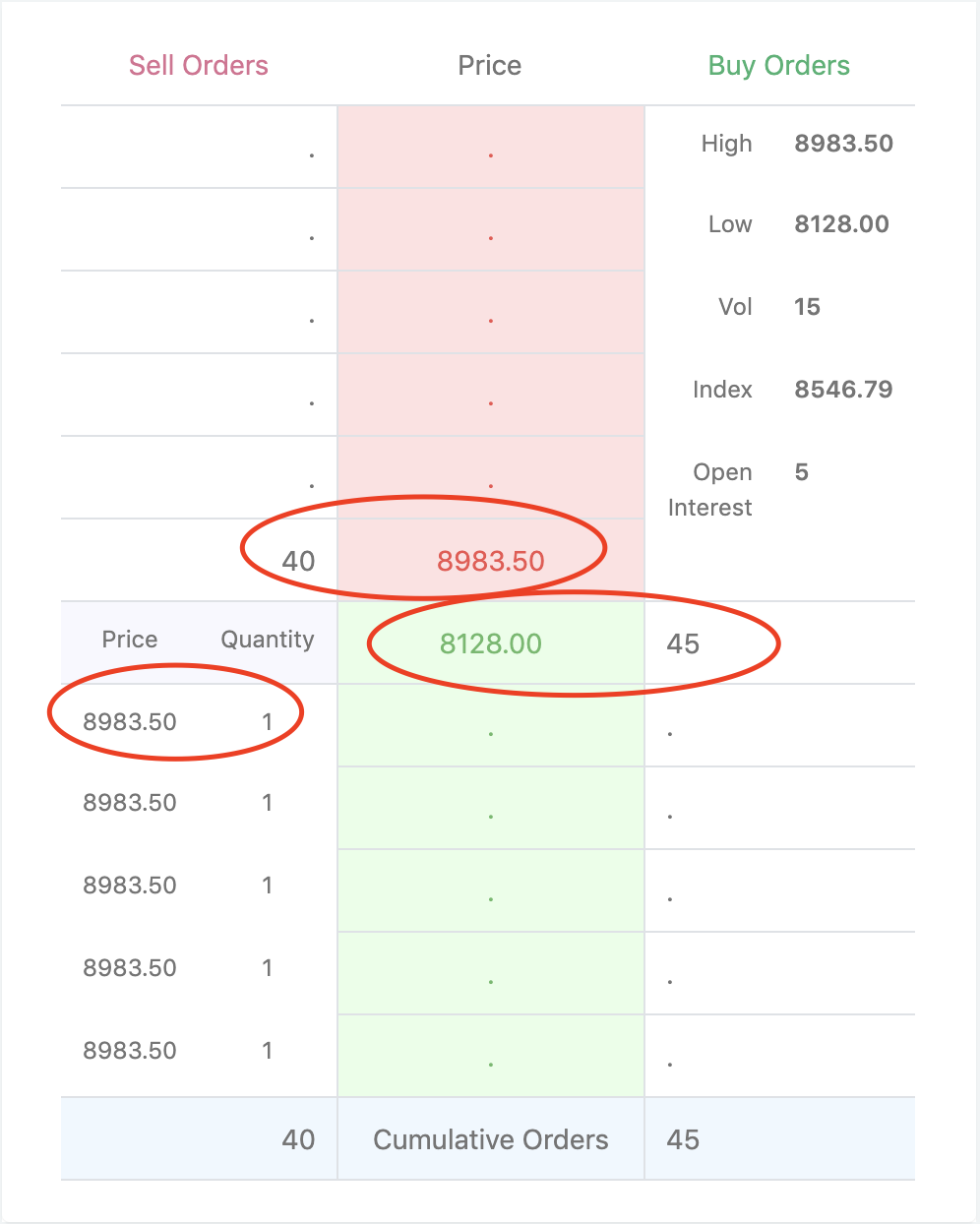

1. Order book

First, let's learn what the order book is.

On the order book panel, buy orders are displayed in green, and sell orders are displayed in red.

You can see that there are 40 sell orders at $8983.50 and 45 buy orders at $8128.00.

Also, in the bottom left corner, you can see that the latest trade was made at $8983.50

Pretty easy, right?

Because this is futures and options product, there's index and open interest tab in the upper right corner.

The index is the Bitcoin price average from Crypto Compare, and open interest is the number of unsettled contracts of the instrument.

Remember, you can always clear positions before maturity by taking the opposite position at the market!

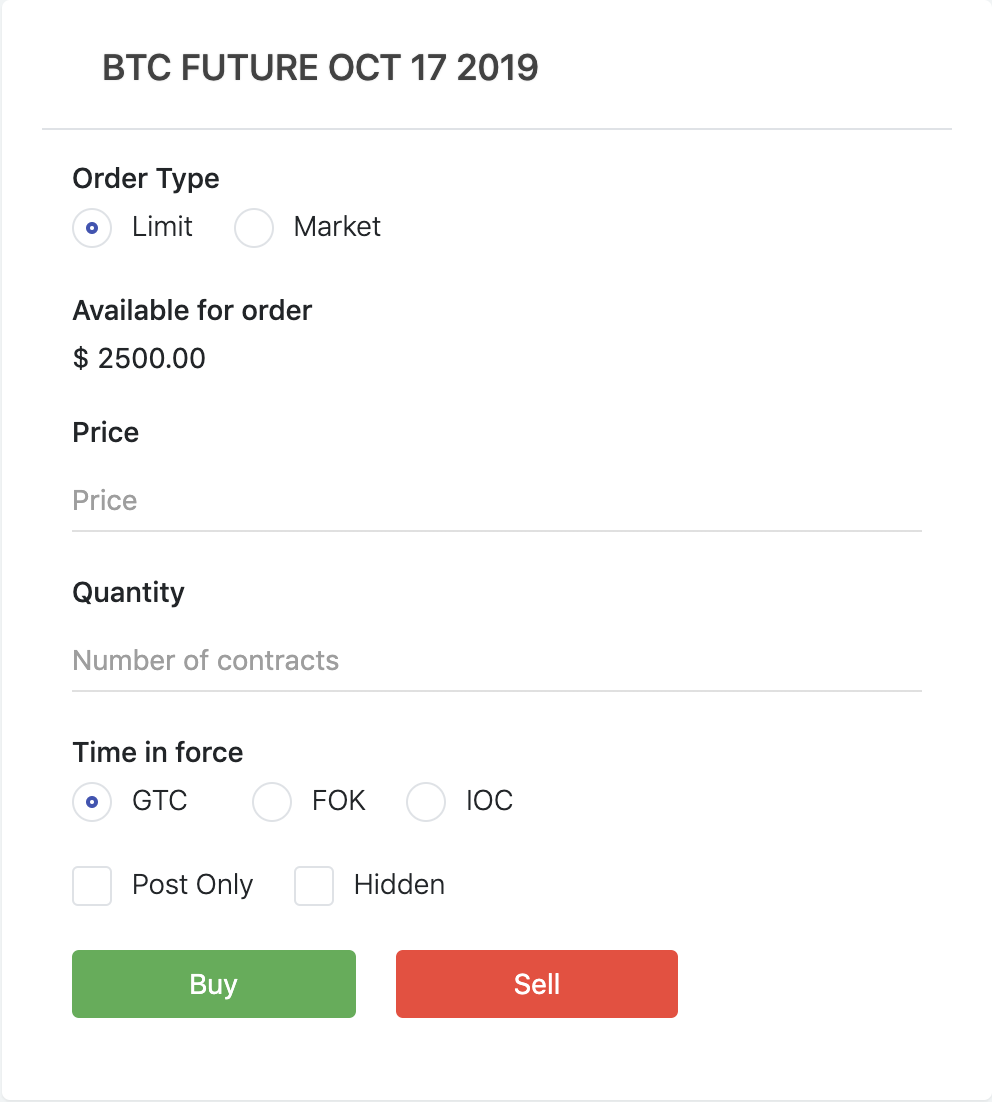

2. Order panel

Let's take a look at the order panel.

The first thing you will notice is the "Limit" and "Market" buttons.

A limit order means that the order will be executed at or better than the order's designated price, and a market order means that you intend to execute the order whatever the current market price is.

When there's not enough liquidity in the market, bid and ask spread tend to get larger. In this case, we recommend submitting a limit order and waiting for it to be executed rather than submitting a market order and paying a huge spread gap.

Next, you need to know the time in force type.

"GTC" means good until canceled. (the most typical order type)

"FOK" means fill or kill. (no partial filling of orders)

"IOC" means immediate or cancel. (immediate execution or cancel the order)

Easy, right? In most cases, people use "GTC" type, and "FOK" and "IOC" are often used in automated trading programs.

Lastly, there's Post order and Hidden order.

Post order means you will always submit a maker order. That means your order will not be immediately executed, and you intend to add liquidity in the order book.

If so, what would happen if you submit a "Post" buy order with a higher price than the market price? (which would normally be immediately executed)

It is particularly useful when you want to hide your intent or positions while submitting an order. (which, of course, would incur additional fees for hiding your orders from the order book)

3. Initial margin and maintenance margin

Before submitting an order, you need to know what is the initial margin and the maintenance margin.

Initial margin means the margin required to submit an order.

Maintenance margin means the margin required to guarantee your obligations on the maturity date.

What that means your balance must exceed the initial margin requirement to submit an order.

And, if you have a loss in your positions, you must check your balance exceeds the maintenance margin. Otherwise, your position will be automatically liquidated by the system.

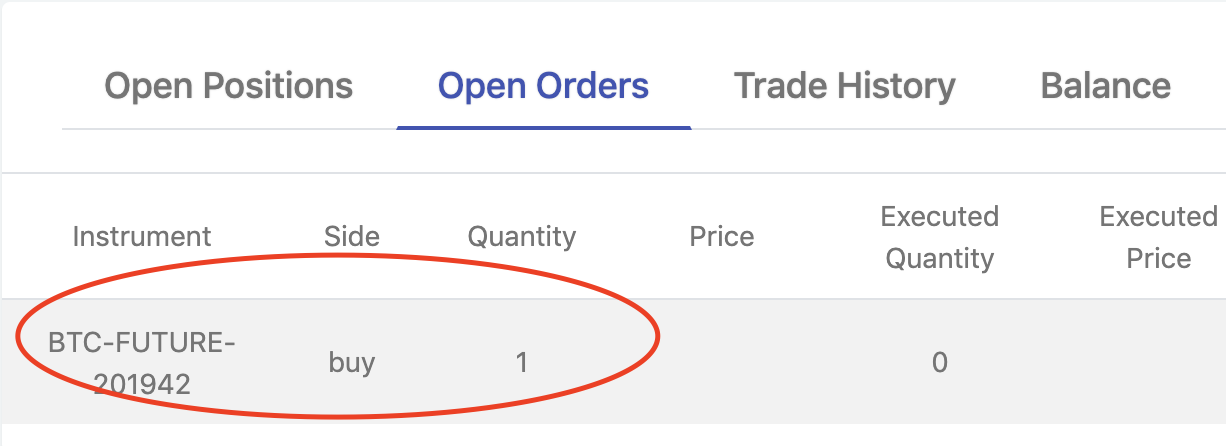

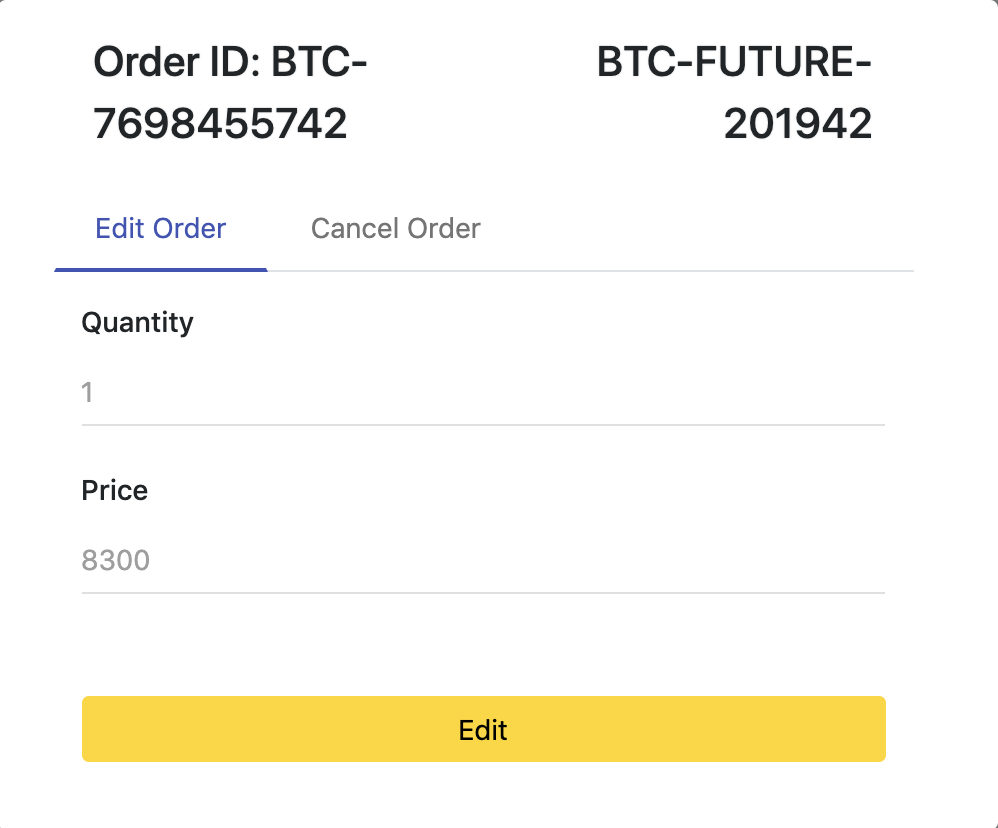

4. Order edit and cancel

Now, let's learn how to edit and cancel an order!

When you have an unexecuted order, you will be able to see that in the open orders tab.

Press the red circled area (described in the image above), and you will see this popup.

You can enter your desired price and quantity and submit an order edit request.

Important! Partially executed orders are unable to be modified; therefore they need to be canceled and resubmitted.

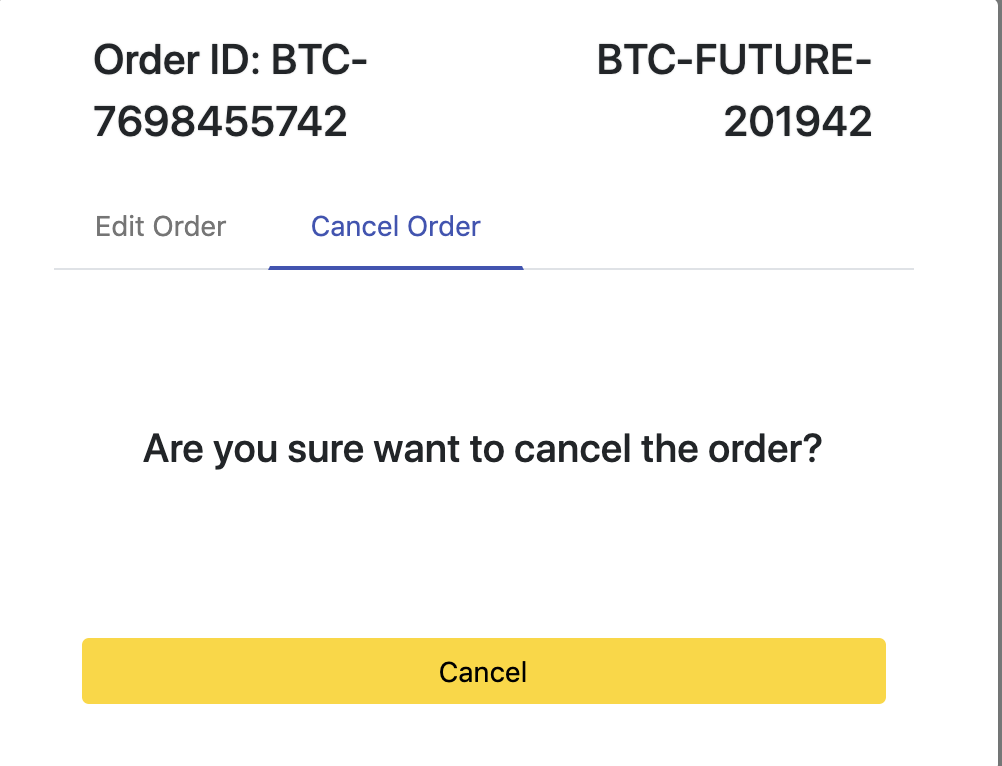

In the cancel tab,

you will see this!

Pressing the cancel button will immediately cancel your order.

How were the instructions? Everything is clear and pretty easy to understand, right?

If you still have any questions, please send us an email to customer.service@optionpool.com and we will be happy to assist you further!

We wish you every success in investments!